In a crypto world defined by high-speed markets and ever-evolving narratives, Hyperliquid has emerged as a new blueprint for what a truly decentralized exchange can look like. Built from the ground up on its own custom Layer 1, Hyperliquid blends the performance of centralized exchanges with the transparency and autonomy of DeFi. No venture capital. No off-chain matching. Just pure on-chain trading, executed with sub-second speed.

This blog dives deep into Hyperliquid’s architecture, its revolutionary vault system, the role of the HYPE token, and the advantages and risks of using the platform. Whether you’re a trader, DeFi builder, or just curious about where crypto infrastructure is heading, this is your comprehensive guide to the project that’s rewriting the DEX playbook.

📦 Platform Overview

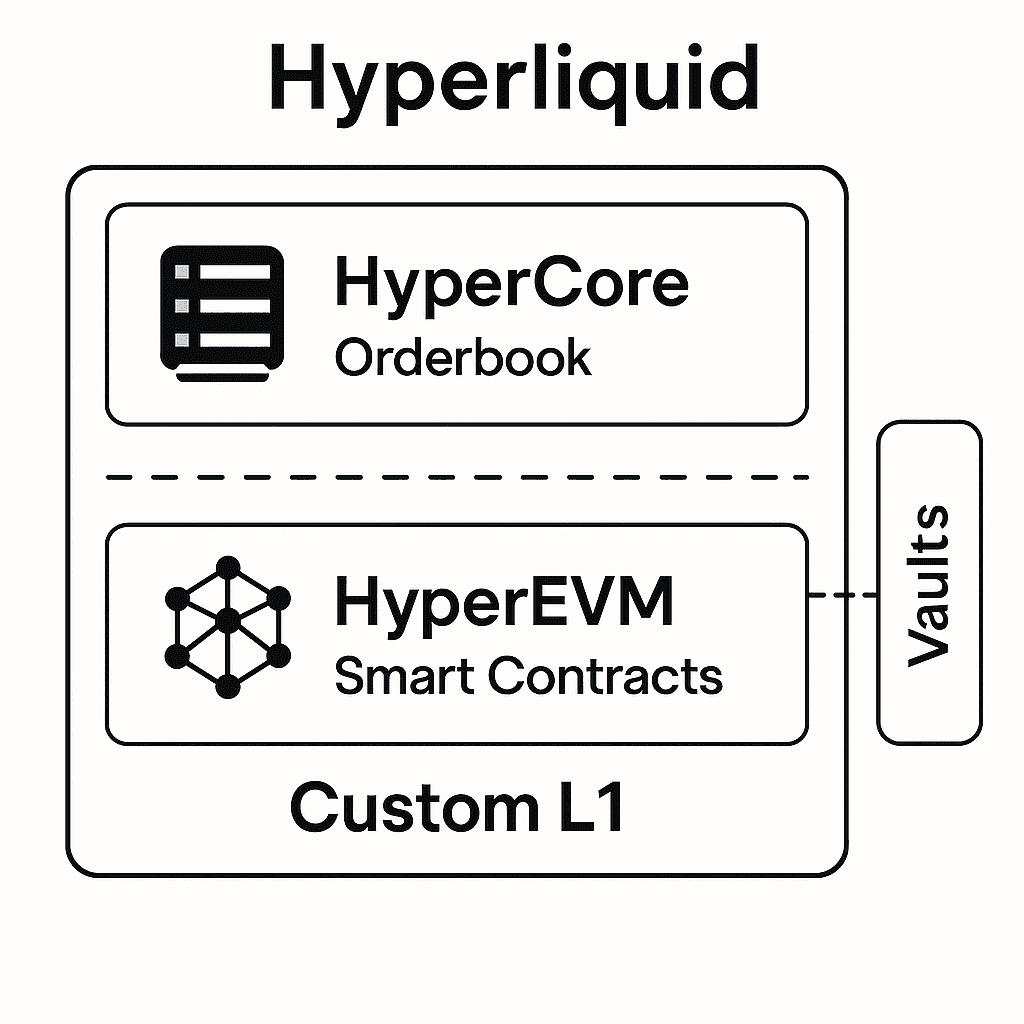

Hyperliquid is a decentralized perpetual futures exchange built on its own high-performance L1. Unlike DEXs that rely on general-purpose chains like Ethereum or Solana, Hyperliquid integrates the matching engine and ledger directly into the core of its blockchain — delivering centralized exchange-level performance, but fully on-chain.

- Custom L1 with HyperBFT consensus

- On-chain orderbook and instant finality

- Trading engine: HyperCore

- Smart contract compatibility via HyperEVM

The architecture enables a trading experience with latency under 1 second, support for 50× leverage, and gasless trades — all settled transparently and immutably on-chain.

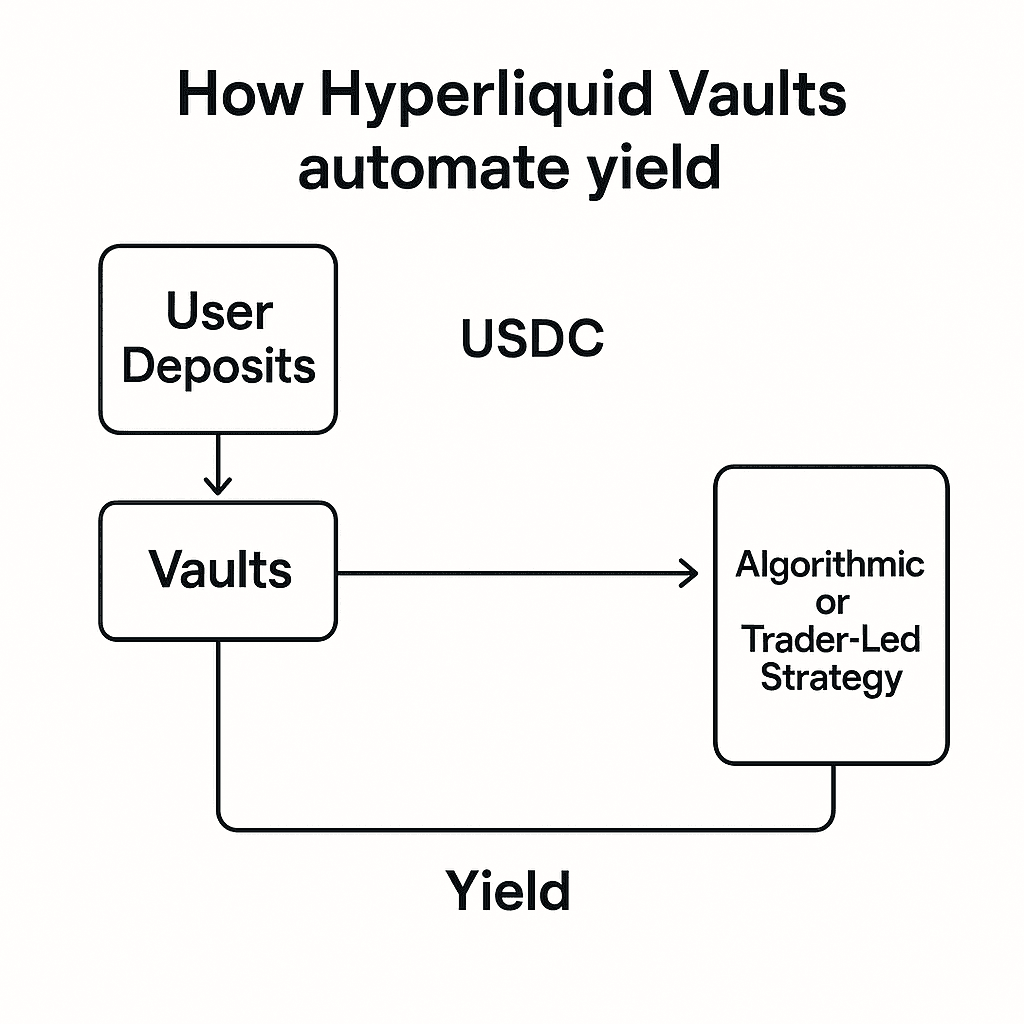

🔁 Vaults: Passive Yield from On-Chain Strategies

Hyperliquid Vaults are one of its most innovative features. These are fully on-chain, managed accounts that pool user funds and execute trading strategies on behalf of depositors. Users can earn a share of the strategy’s PnL without giving up custody of their funds.

Main vaults include:

- HLP (Hyperliquidity Provider): Market-making and liquidation backstop

- Liquidator Vault: Earns profits from closing undercollateralized positions

- User-Created Vaults: Custom strategies with 10% performance fee to the vault manager

All vaults are transparent, trustless, and enforceable by smart contract — making the a breakthrough for social investing and automated DeFi strategies.

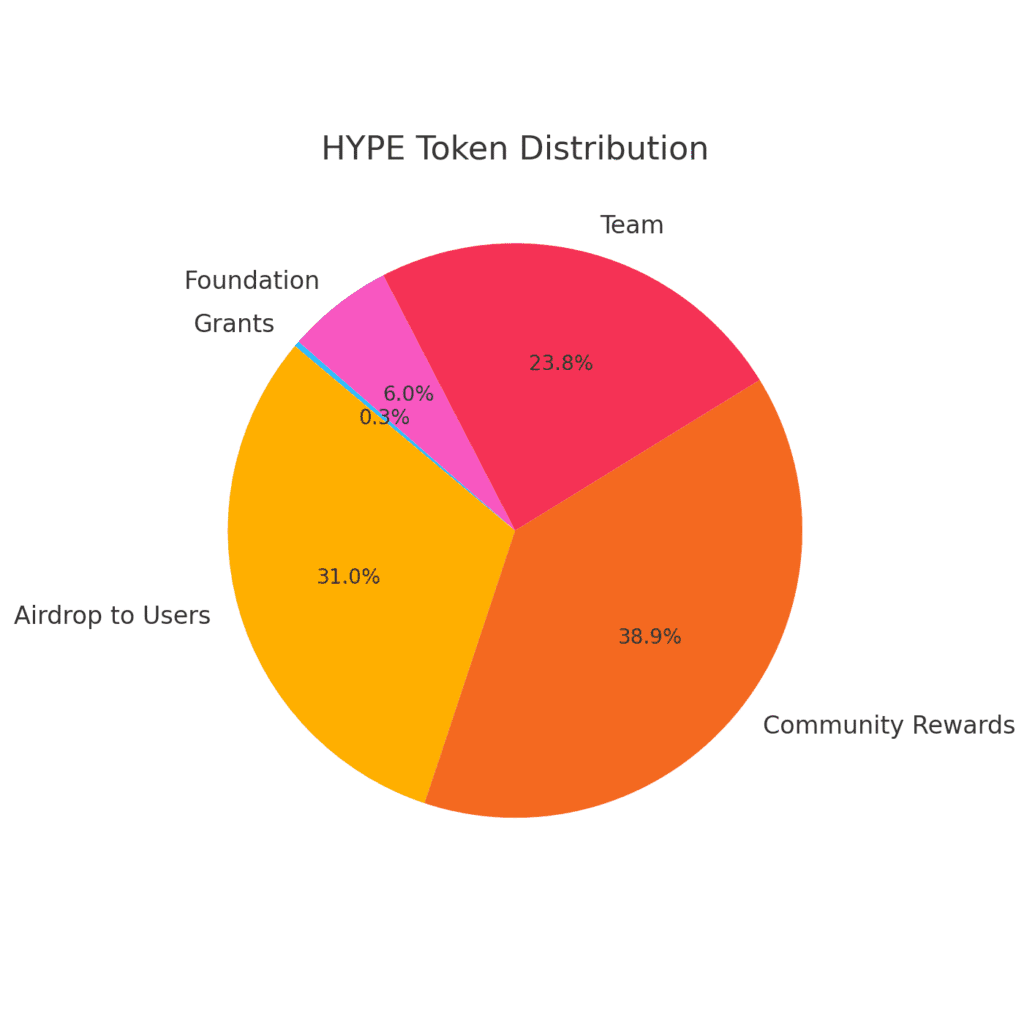

📊 HYPE Tokenomics: Powering and Governing the Chain

HYPE is Hyperliquid’s native token and plays a critical role in:

- Staking and securing the network (HyperBFT)

- Gas payments for HyperEVM dApps

- Governance over upgrades and proposals

Token Distribution:

- 31% airdropped to users (no VCs!)

- 38.88% for future rewards and emissions

- 23.8% to the team

- 6% to the Hyper Foundation

📈 Growth and Performance

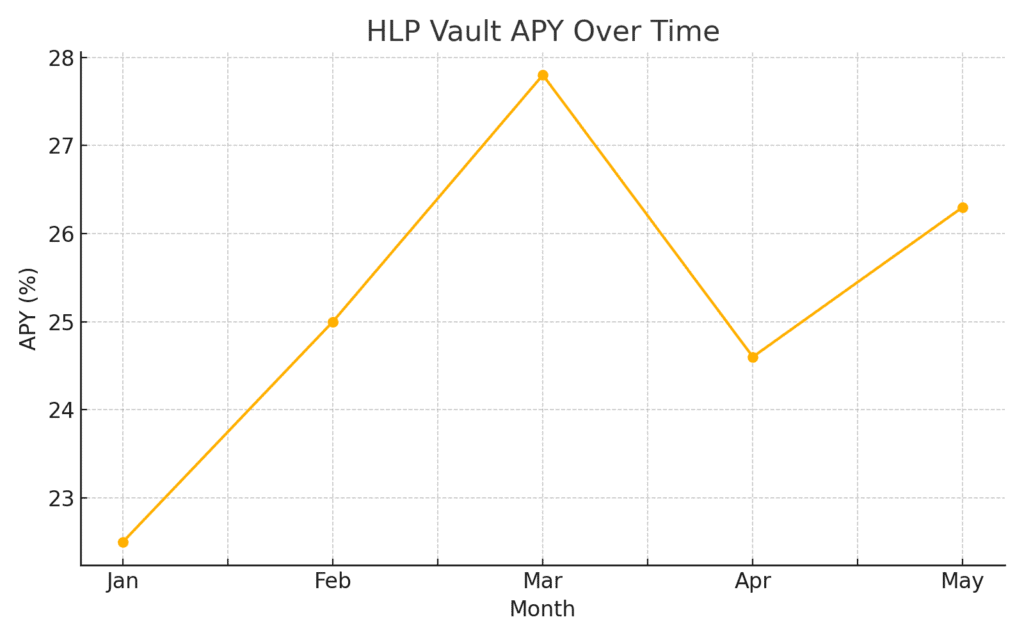

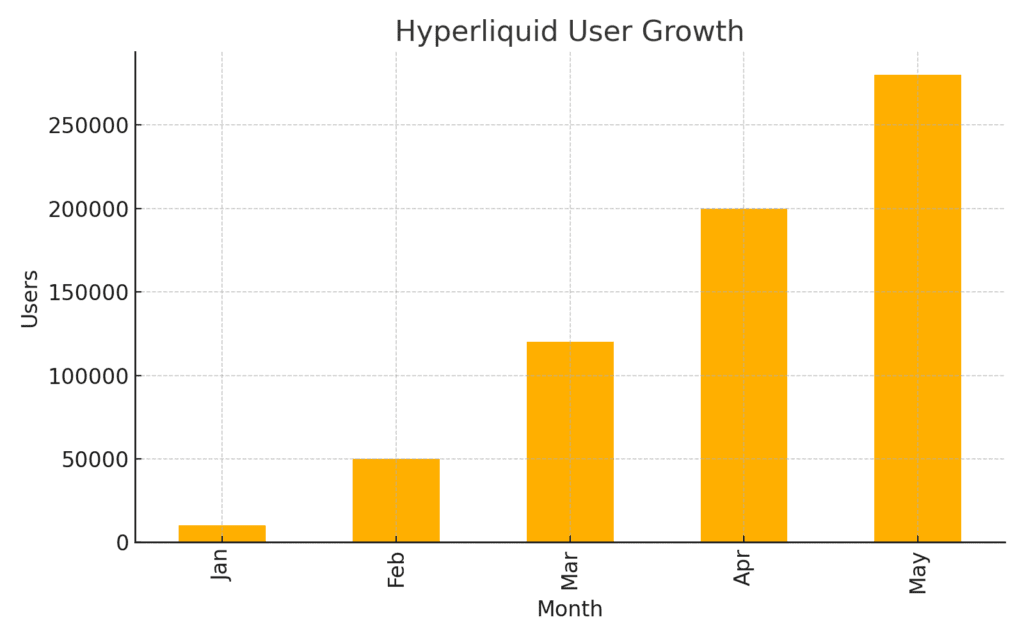

Since launch, Hyperliquid has consistently ranked among the top on-chain derivatives platforms. Its vaults have shown strong returns (HLP ~25% APY) and it boasts over 280K users with billions in trading volume.

⚠️ Risks and Considerations

While Hyperliquid offers many advantages, it’s still a new chain with novel mechanics. Risks include:

- Smart contract bugs

- Market volatility and vault drawdowns

- Centralization early in validator set

- Bridge vulnerabilities

However, the team has been proactive, transparent, and user-focused in handling incidents like attempted exploits.

🧠 Final Thoughts

Hyperliquid is one of the most exciting experiments in DeFi today — pushing the boundaries of what’s possible when you combine speed, decentralization, and user-first economics. With no VC pressure and a thriving community, it represents a rare opportunity in crypto: a powerful tool, built for traders, by traders.

Whether you’re earning passive yield through vaults, staking HYPE, or executing your first on-chain trade at lightning speed — Hyperliquid is worth watching, and maybe even diving into.

👉 Explore the platform: https://hyperliquid.xyz