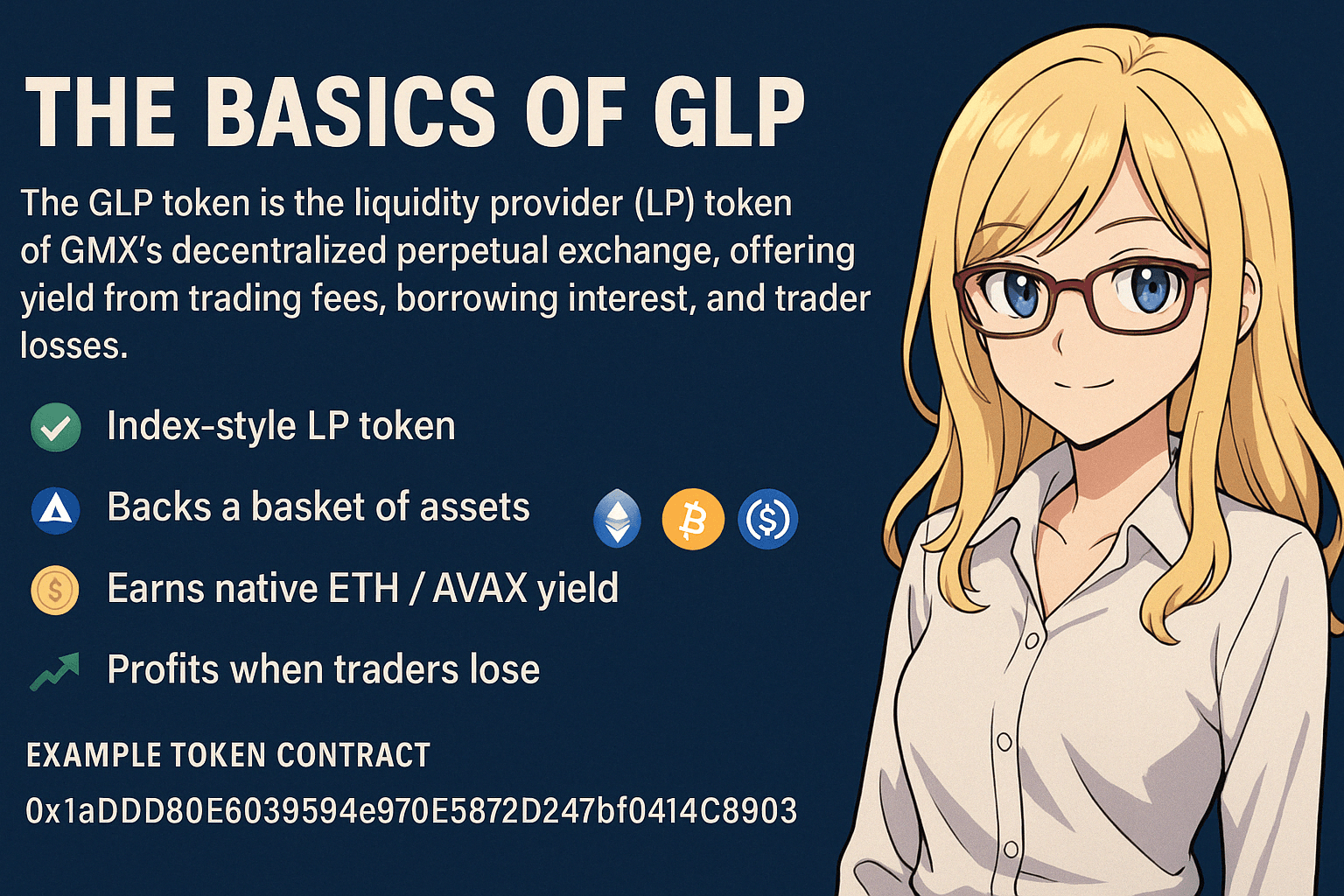

The GLP token is one of the most innovative liquidity primitives in decentralized finance. Created as the liquidity provider (LP) token for GMX V1, GLP powers GMX’s decentralized perpetual exchange, offering yield through trading fees, swap fees, borrowing interest, and PnL exposure from leveraged traders. But behind the simplicity of staking GLP lies a deeper financial machine with asymmetric risk-reward mechanics, synthetic exposure, and a counter-cyclic use case that helped it survive and even thrive during bear markets.

In this blog, we break down:

- What GLP is and how it works

- Benefits for holders

- Risks and trade-offs

- GLP in bear markets

- How the GLP pool is evolving in 2025

📌 What is GLP?

GLP is the index-style LP token backing GMX’s spot and perpetual trading system on Arbitrum and Avalanche. It represents a share in a dynamic pool of crypto assets (including ETH, BTC, stablecoins, and altcoins) used by traders for leverage.

🔄 GLP Functions:

- Provides liquidity for swaps and leveraged trading

- Earns revenue from: trading fees, borrowing interest, and liquidations

- Absorbs trader PnL: when traders win, GLP loses; when traders lose, GLP profits

🔗 Token Contract:

- Arbitrum:

0x1aDDD80E6039594eE970E5872D247bf0414C8903 - Avalanche:

0x9e295B5B976a184B14aD8cd72413aD846C299660

💰 GLP Yield & Benefits

GLP rewards stakers with:

- Escrowed GMX (esGMX)

- ETH / AVAX native yield

📈 Sources of Yield:

- Swap Fees: GLP facilitates swaps between tokens in its pool

- Borrowing Fees: charged to traders using leverage

- Trading PnL: GLP is the counterparty to all leveraged traders

If traders net lose, GLP holders gain value. This makes GLP yield negatively correlated to the profitability of degens on the platform.

🛡️ Hedging Through Token Weights

GLP dynamically adjusts its asset composition (called token weights) based on:

- Current market conditions

- Open long/short positions on GMX

This means GLP can be synthetically long or short major assets like ETH. Token weightings shift to hedge against trader exposure.

⚠️ Risks of Holding GLP

While GLP sounds like a dream LP token, it has nuanced risk:

🔀 Counterparty Risk

- You are the house — when traders win, you lose

- If a whale wins big (especially in volatile markets), GLP may take significant loss

⚖️ Synthetic Exposure

- You may have exposure to short/long positions on ETH, BTC, etc., even if the assets aren’t in the pool

- Bullish markets where traders go long and win = bad for GLP

🔐 Smart Contract Risk

- Though GMX is audited and battle-tested, all DeFi carries inherent smart contract risks

- Bridged tokens (e.g. USDC) and price oracles (e.g. Chainlink) introduce dependencies

📉 Peg Risk

- GLP contains stablecoins, which may depeg (e.g., USDC, USDT risk during crises)

🧊 GLP’s Bear Market Performance

One of GLP’s unique qualities is its resilience in bearish markets. Why?

😬 Traders Lose More in Bear Markets

- In choppy and bearish markets, leverage traders often mis-time long positions

- When those positions are liquidated, GLP holders capture the losses as yield

🏦 Stablecoin-Heavy Allocations

- GLP index often overweights stablecoins when traders are net short

- This reduces volatility for GLP holders, providing synthetic short exposure

📉 ETH/AVAX Rewards Surge During Panic

- During market downturns, trading activity surges, leading to higher protocol fees

- GLP stakers benefit from higher volume and failed trades

🌍 GLP in 2025: Key Evolutions

🔁 Transition from V1 to GMX V2

- GMX V2 introduces isolated pools, risk segmentation, and new products

- GLP remains active for GMX V1, with long-tail support

🧠 Enhanced Tokenomics

- esGMX vesting mechanics incentivize long-term alignment

- Auto-compounding ETH rewards make it hands-off

📊 Analytics

- GLP dashboards available at stats.gmx.io

- Tracks trader vs. GLP PnL, pool weights, APYs, and more

🧾 TL;DR: Should You Hold GLP?

✅ Pros

- Earn real protocol revenue

- Negatively correlated with trader success

- Passive ETH yield (compounds)

- Synthetic hedging via token weights

⚠️ Cons

- Risk of loss if traders are profitable

- Dynamic index exposure = not simple HODL

- Bridged/stablecoin reliance

- Smart contract exposure

GLP is a high-conviction bet on trader failure and DeFi fee flow — and during chaos, it might just outperform the rest.

Curious? Start at gmx.io and explore the GLP dashboard at stats.gmx.io.